Money has been a red-hot topic in every generation particularly to today’s “millennials”. This makes financial literacy and management an essential tool to thrive on this aspect. Looking up the latest money tips, everyone just wants to earn, save and invest. But the concept of money and savings is tainted with doubts, disappointments, and disasters due to lack of right information, system, and decisions.

Now, I want to discuss money in comparison with “love”. Interesting, right? I am not saying we must love money, rather money has some unique qualities that are comparable to love. How do you love? Can love grow? Can love be shared and given? Can love return to the lover? Can love be lost? Now, let’s talk about love and money!

Money Tips: Love, just like money, is investible.

Everyone has the ability and the potential to love. It’s in our nature. We love and crave for love. Love is a powerful thing that can grow in time. It becomes undefiable when we know how to invest it in a right person. To grow love, we invest our time, emotion, and our resources. This is one picture of money. We can’t deny that money is an essential thing today. We all have the ability and the potential to earn money. But, to maintain or even grow the money we have, we must be dead sure on how and where we invest it. Understand different aspects of investments from bank saving to an insurance policy or to shares and stakeholdings. Each investment option has its purpose and perks. Just like in savings, invest your money in the bank when it’s a short-term period (from time-to-time you can withdraw) while you can invest in an insurance or a house renovation when it’s a long-term one.

Money Tips: Love, just like money, doesn’t always yield to an ROI at your first shot.

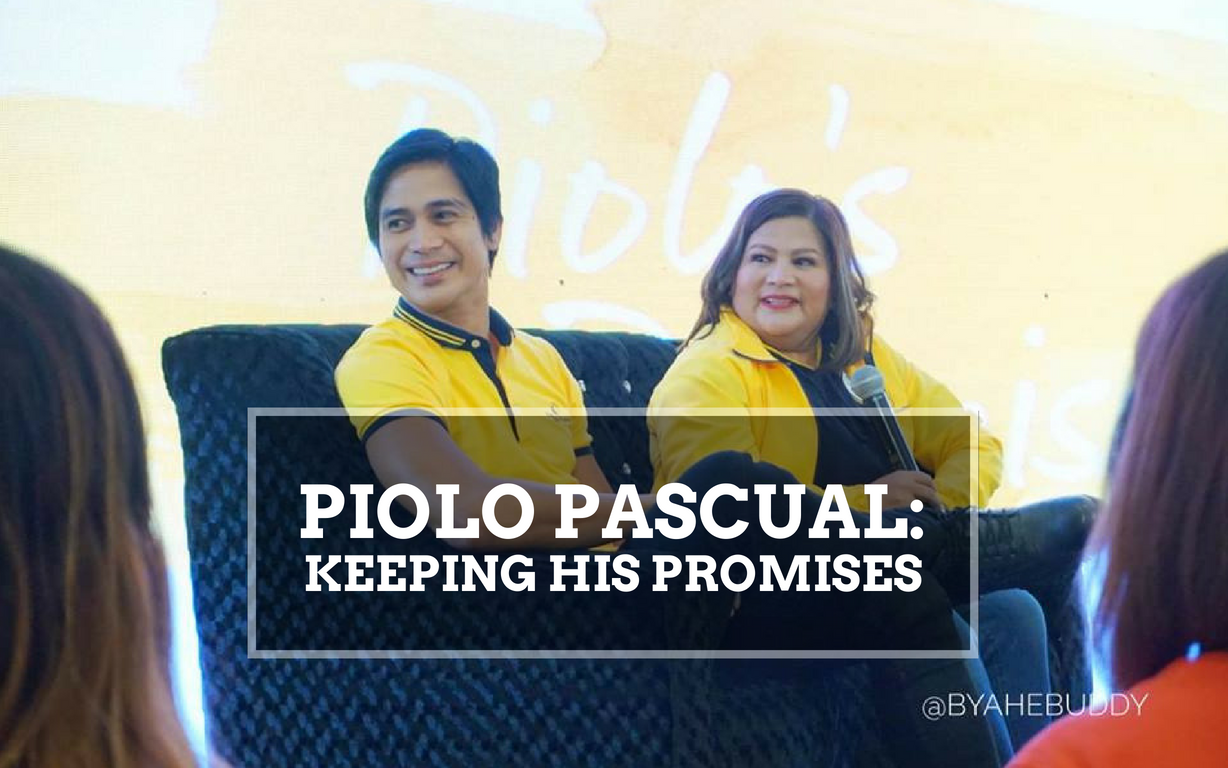

Not all who fell in love for the first time gets the jackpot. Not all first love stories succeeded to stay strong and intact for years. Some fell to the ground, while others realized it’s not working and went to next relationship. Sometimes, it takes several heartbreaks to arrive in your destined life partner. Most of the relationships grew outside the first shot of love. In like manner, you have no assurance that your money invested in something will return to you in folds. Even the Giant of the Giants, Bill Gates and his team, once had an investment that did not turn out well.

“Despite efforts to sell our wares as far afield as South America, we had virtually no customers. Traf-O-Data was a good idea with a flawed business model. It hadn’t occurred to us to do any market research, and we had no idea how hard it would be to get capital commitments from municipalities. Between 1974 and 1980, Traf-O-Data totaled net losses of $3,494. We closed shop shortly thereafter.” – Paul Allen

When it happens, that your investment fails, don’t lose the vigor of your life. But just like these people, don’t give up. Arise and account another day into your history book. Learn from it and better yourself. That is the best ROI from a failed investment.

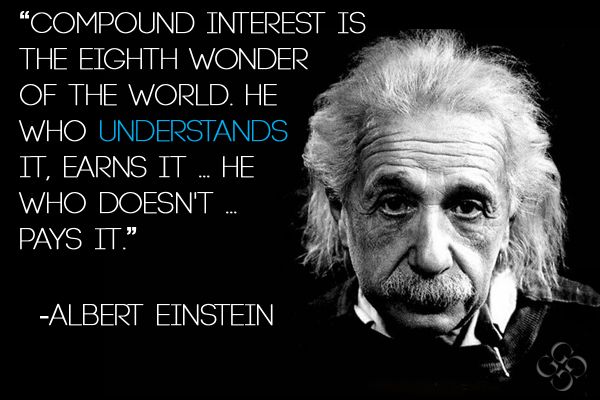

Money Tips: Love, just like money, earns a compound interest.

With the right investment of your time, emotions and resources in love, you can never imagine the return of it all. You will never know the weight of your investment until its return has been recognized. Just like that, your money in the right investment will go nowhere but to return with interest. As it does not always yield to an ROI at the first glance, it takes your time, consistency and right decision to start a life-long dream of compound interest. Start now, and continue with consistency. If you grasp the power of a compound interest, surely success will just flood you on your doorsteps.

Money Tips: Love, just like money, is best when shared with the right people.

Love that is expressed and shared with the right people can be the best leisure to spend your resources. Just like that, when we earn to have money, one way that we can enjoy it is to spend some with our family, friends and special someone. It is because we are creatures of memories. We tend to create memories in order to make our future. We spend our money to create memories that will propel and push us into motivation. The laughter, joy and hilarious moment spend with the right people is another ROI. Why not? Money matters. But memory matters more and family matters most. Do not be afraid to spend some of it for good memoir’s sake.

Become your own storyteller and blogger!

GET MY FREE EBOOK

Money Tips: Love, just like money, must be managed properly to save some for one’s self.

When in love, never forget to leave some of the love for yourself. Never go empty trying to spread your love everywhere that you go so thin. As what Jesus said, love your neighbor as you love yourself. Based on the construction of the sentence, loving your neighbor comes first. But in essence, loving yourself came first being the standard given. We project our love to others reflecting how we love ourselves. We cannot give what we don’t have essentially.

Much the same, let’s not spend all our money that at the end of the day we don’t have money left for our own tomorrow. Savings will save us when our external investment heads on to fail at some point. Just like love, when the relationship won’t work out anymore, that same love you have for yourself will keep your sanity. We can achieve this by having a proper financial management that won’t make us sacrifice a lot while we save a portion of our finances. From a little amount, begin to gradually increase it periodically. Start saving now!

Parting Words of Love

Love and money have a lot in common in a good sense. I don’t know what you went through both in love and in money. You might have gone through high water or hell fire. You might have made it through the flood and the brimstones. But I want to say to your total being. You have gone through what you have gone through, even when it hurts so much, just to learn things books can’t give you; blogs can’t give you; your coach can’t give you; your teacher can’t give you; your adviser can’t give you. That is your best ROI for you to start afresh and to become who you are today. It was not about the people around you nor the money that you only had. But it was all about the potential that is in you. You must understand that what you have in you is something you can invest to grow it, share it, and enjoy it.

No matter how hard it is to earn, save and grow your money, DO NOT GIVE UP!

Never give up on something that you can’t go a day without thinking about. – Sir Winston Churchill

Check out other events in this blog!